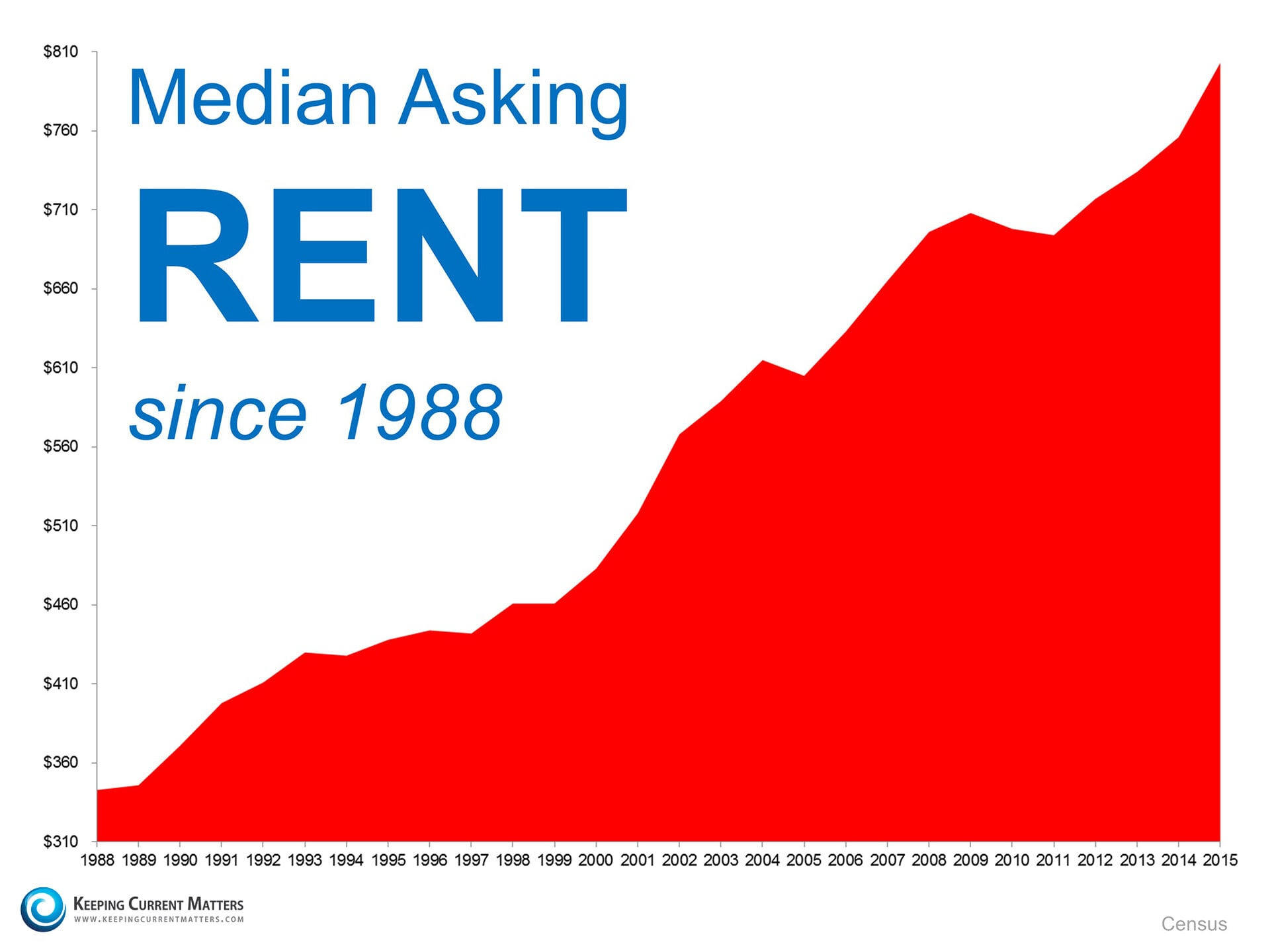

Yesterday the Federal Reserve raised short term interest rates .250% which you could see coming. Rates increased about .250% on long term mortgages not because of the short term hike, but because of what the Federal Reserve said. The Fed said that they are looking to raise rates 3 times next year which is why the bond market sold off and yields soared on the 10 year bond to 2.61%. This is the highest level since December of 2013 and rates can still go higher.

I think that this is an overreaction to what has been perceived as a growing economy with no economic growth. The Federal Reserve said that they would raise rates 2-3 times this year when they raised rates 364 days ago, this is the first time they have raised them since! Now they are saying that they will raise it 3 times in 2017. Really? Is the economy going to be that good? I hope so, but I highly doubt it. They are trying to forecast what will happen in the future. Nobody can predict the future and you don't know if you are right until the future becomes the past. SO rates are a little higher. We have had 43 months with rates in the 3's in the past 45+ years! Believe it or not, we have also had 43 months in the 4's in the past 45+ years. Well, the 4's are about to take the lead and the 3's could be out of the game for quite a while.

Interest rates are just a number. If you need to buy a house, you buys a house, if you need to sell a house, you sell a house.

A principal and interest payment at 3.625% for a $400,000.00 loan was $1824.21 and at 4.375% it will be $1997.14. Your payment goes up about $173 a month and you get an additional write off.

Accept where rates are and let's make a move! In fact, if you are worried about rates increasing further, you may want to give me a call and make the decision sooner than later and avoid any further rate hikes from the Feds in 2017.

If you are curious about interest rates, buying or selling a home, buying an investment property or reinancing your current loan, call Mike Meena, Augusta Financial today. His cell phone number is 661-714-6258 or 661-260-2970.

Wendy Gundry

REMAX of Santa Clarita

BRE# 01250162

661-702-4767